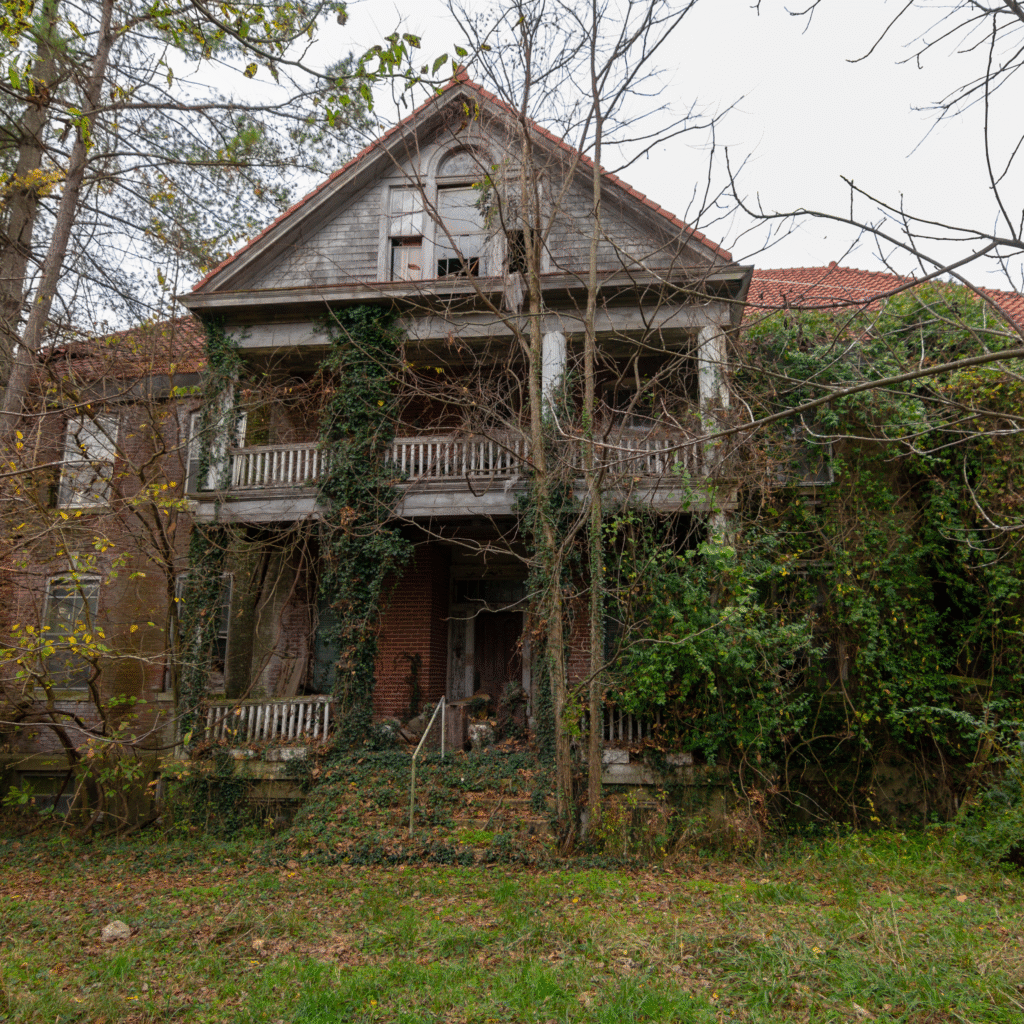

A condemned house is one of the toughest property challenges a Memphis homeowner can face. Once the city or county declares a property unsafe, you can’t legally live in it until major repairs are made. The problem? Repairs often cost more than the house is worth, leaving owners feeling trapped.

If you’re in this situation, you’re not alone. Many Memphis residents have had to decide between paying for costly rehab or selling their property as-is. In this blog, we’ll break down Tennessee’s condemnation rules, what repairs really cost, and how selling directly to buyers—like cash home buyers in Memphis—can sometimes be the smarter move.

Why Homes Get Condemned in Memphis

A house can be condemned for several reasons, but they usually boil down to health and safety concerns. Common causes include:

- Structural failure (foundation cracks, collapsing roof).

- Fire or flood damage that hasn’t been repaired.

- Toxic hazards like mold, asbestos, or lead.

- Unsafe electrical or plumbing systems.

- Long-term neglect or vandalism in vacant homes.

When code enforcement steps in, they don’t just put a sticker on your door. You’ll receive official notices, deadlines for compliance, and potential fines if you ignore the orders.

Tennessee Condemnation Process

The condemnation process in Tennessee follows a clear sequence:

- Inspection: City officials inspect the property after complaints, fire, or safety concerns.

- Notice of Violation: You’re given written notice of issues and a deadline for repairs.

- Condemnation Order: If problems remain, the property is declared uninhabitable.

- Vacancy: Tenants or owners must vacate immediately.

- Demolition Risk: If nothing is done, the city may move forward with demolition and bill you for it.

The Real Cost of Rehab

Repairing a condemned home isn’t like fixing up a dated kitchen—it usually means full-scale reconstruction. Some rough numbers:

- Foundation & structural fixes: $30,000–$70,000

- Roof replacement: $12,000–$20,000

- Electrical overhaul: $10,000–$25,000

- Plumbing replacement: $12,000–$25,000

- Mold/asbestos remediation: $15,000–$40,000

- City permits and inspections: $5,000–$10,000

Add in holding costs (insurance, taxes, utilities), and you could easily be $100K+ into the project. The scary part? In many Memphis neighborhoods, the after-repair value (ARV) may not even cover that investment.

Rehab Risks

Even if you’ve got the money, rehab carries serious risks:

- Hidden costs: Tear down walls and you may find termite damage, rotted beams, or sewer issues.

- City red tape: Multiple inspections can stall progress.

- Timeline creep: A project that’s supposed to take 6 months can stretch to a year.

- Uncertain resale: Some buyers avoid properties with a condemnation history, no matter how nice they look post-rehab.

Selling As-Is: A Practical Alternative

When the numbers don’t make sense for rehab, many owners look at as-is sales. You won’t get top dollar, but you avoid spending money you don’t have.

This is where investors and specialized buyers come in. Many advertise with lines like we buy houses Memphis because that’s exactly what they do—purchase distressed, condemned, or problem properties outright. They take on the risk, handle the permits, and manage repairs.

Options for As-Is Sales in Memphis

- Direct sale to an investor – Fast, straightforward, often closes in under 3 weeks.

- Auction – Quick but unpredictable. You may walk away with less than expected.

- Wholesaling – A middleman assigns your contract to another buyer; not always fastest.

- MLS Listing – Possible, but financing issues mean most buyers won’t qualify for a condemned property.

Numbers Comparison: Rehab vs. As-Is

Scenario A: Full Rehab

- Cost of repairs: $95,000

- ARV (after-repair value): $135,000

- Closing/agent fees: $9,000

- Net gain: ~$31,000 (after months of stress).

Scenario B: As-Is Sale

- Offer from investor: $50,000

- Closing costs: $2,000

- Repairs: $0

- Net: $48,000 (done in weeks).

👉 In many cases, the as-is sale yields nearly the same profit—or even more—without the stress and risk of rehab.

Tennessee-Specific Considerations

- City liens: If Memphis demolishes your house, the cost becomes a lien.

- Disclosures: By law, you must disclose known defects, though as-is buyers generally accept the risks.

- Title checks: Expect investors to verify there are no unresolved tax liens or ownership disputes.

Who Buys Condemned Houses in Memphis?

Condemned homes are rarely purchased by regular buyers. Instead, the buyers are typically:

- Local investors and rehabbers.

- Developers looking for land.

- Professional companies marketing “sell house fast Memphis” services.

These buyers can pay cash, close quickly, and accept properties in any condition.

Benefits of an As-Is Sale

- Speed: No waiting months for inspections or permits.

- No repair costs: Save tens of thousands of dollars.

- Certainty: No lender requirements or appraisal issues.

- Stress-free: Walk away from the property without fines or demolition risk.

FAQs

Q1. Is it possible to sell a condemned house in Memphis?

Yes. While you can’t live in it, investors and specialized buyers purchase condemned houses as-is.

Q2. Do I have to repair a condemned house before selling?

No. Repairs are optional, but they can be very expensive. Many sellers choose to sell as-is to avoid the financial burden.

Q3. What happens if the city demolishes my house?

If the city demolishes your home, the cost is placed as a lien against your property. Selling before demolition avoids this issue.

Q4. Who buys condemned houses?

Local investors, developers, and companies that advertise “we buy houses Memphis” often purchase condemned homes in any condition.

Q5. How fast can I close on a condemned house sale?

Cash investors can often close in 1–3 weeks, while traditional listings may take several months.

Final Thoughts

A condemned house in Memphis is more than just a repair project—it’s a financial and emotional burden. While fixing it may sound noble, the costs and risks often outweigh the rewards. Selling as-is can be the cleanest, most practical way forward.

By understanding Tennessee’s condemnation rules and comparing rehab costs against as-is offers, you can make a smart decision for your future. Whether you partner with investors, developers, or professionals who market themselves as cash home buyers in Memphis, your priority should be protecting your finances, avoiding city penalties, and moving forward with peace of mind.